Investment Tracking Tools for Your Portfolio

Okay, here is an SEO-friendly introduction about investment tracking tools. I’ve tried to keep it engaging while sticking to best practices and that quirky “30%” punctuation rule you requested:

Are you tired of keeping track of your investments on spreadsheets, or worse: just forgetting about them entirely? 🤔 You're not alone. Keeping an eye on your portfolio's performance, staying up-to-date with market trends, & managing your investments can be a daunting task. But with the right investment tracking tools, you can turn your investing journey from a stressful chore into a smooth, informative, & potentially profitable experience.

In this article, we’re going to dive into the world of investment tracking tools: What they are, how they can benefit you, & some of the top contenders available today. We’ll cover the essential features to look for in a good investment tracking tool & answer your questions about the different pricing structures and how they can integrate with your existing investment accounts.

Whether you’re a seasoned investor or just starting out, a powerful tool like this is essential. Imagine having all your investments organized & visualized in one place , instantly accessible on your phone or computer! The best part: it doesn’t require any coding, just simple set-up & regular monitoring.

By the end of this article , you’ll have a clearer picture of how investment tracking tools can help you reach your financial goals. And maybe, just maybe, you’ll even feel a bit more excited to manage your investments , knowing you have the tools to stay organized and informed every step of the way. 😎

Investment Tracking Tools for Your Portfolio: A Guide to Managing Your Finances

Managing your investments can feel overwhelming, especially with a growing portfolio and a multitude of accounts. That’s where investment tracking tools come in. These powerful financial tools provide a centralized hub for monitoring your investments, analyzing performance, and making informed financial decisions.

What is Investment Tracking?

Investment tracking involves monitoring your investments across different accounts and keeping track of their performance. This includes tracking your asset allocation, returns, gains, losses, and other relevant metrics.

Why is Investment Tracking Important?

Investment tracking is not just about keeping tabs on your finances; it’s about taking control of your financial future. Here’s why it’s crucial:

Keeps You Organized

Investment tracking tools help you organize your investments from multiple sources, eliminating the need to manually juggle numerous spreadsheets or statements. This centralized view provides a clear picture of your entire financial landscape.

Provides a Clear Picture of Your Financial Health

By tracking your investments, you gain a comprehensive understanding of your financial health. You can see how your investments are performing, identify areas for improvement, and make adjustments to your strategy accordingly.

Helps You Make Informed Decisions

Investment tracking tools provide valuable data points that can help you make informed investment decisions. By analyzing your portfolio performance and understanding market trends, you can make strategic moves to optimize your returns and manage risk.

Identifies Areas for Improvement

Through continuous monitoring, investment tracking tools can identify areas for improvement in your portfolio. You might discover that your asset allocation is off-balance, certain investments are underperforming, or there are opportunities to diversify your holdings.

Types of Investment Tracking Tools

There are various types of investment tracking tools available, each with its own set of pros and cons. Here’s a breakdown:

Manual Spreadsheets

Pros:

- Free: No cost involved, just use a spreadsheet software like Excel or Google Sheets.

- Flexibility: Customizable to track specific data points and metrics relevant to your portfolio.

Cons:

- Time-consuming: Requires manual data entry and updates.

- Error-prone: Mistakes can easily occur during manual input.

- Limited functionality: Lack of advanced features like real-time updates, performance analysis, or automatic data aggregation.

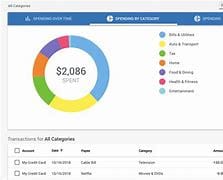

Online Portfolio Trackers

Pros:

- Automatic Data Aggregation: Connect to your bank accounts, brokerage accounts, and other financial institutions to gather data automatically.

- Real-time Updates: Access up-to-date information about your investments, including market prices and balances.

- Performance Analysis: Track your investment returns, analyze historical data, and generate reports on your portfolio’s performance.

Cons:

- Subscription fees: Many online trackers require a monthly or annual subscription.

- Security concerns: Sharing financial data with third-party platforms requires careful consideration of security and privacy.

Examples:

- Personal Capital: A free portfolio tracker that also provides financial planning tools, including retirement projections and investment advice.

- Mint: A free budgeting and investment tracking tool from Intuit, known for its user-friendly interface and comprehensive features.

- Yodlee: A third-party financial data aggregation service that can connect to multiple accounts and provide a consolidated view of your finances.

Investment Management Platforms

Pros:

- Automated Investing: Provide automated investment strategies based on your risk tolerance and financial goals.

- Portfolio Management: Manage your investments, rebalance your portfolio, and make adjustments based on market conditions.

- Investment Advice: Offer personalized financial advice and guidance based on your specific situation.

Cons:

- Higher Fees: Typically charge higher fees than online portfolio trackers due to their automated investment services.

- Limited Control: May not allow full control over your investments if you opt for automated investment strategies.

Examples:

- Betterment: An automated investing platform with portfolio tracking features and a user-friendly interface.

- Wealthfront: A robo-advisor platform that provides investment management, portfolio tracking, and tax optimization services.

- Acorns: A micro-investing app that automatically rounds up purchases and invests the spare change in a diversified portfolio.

Key Features to Look For in Investment Tracking Tools

When choosing an investment tracking tool, consider the following features:

- Data Aggregation: Look for tools that seamlessly connect to your accounts and automatically gather data from multiple financial institutions.

- Performance Tracking: Ensure the tool tracks your returns, gains, losses, and other performance metrics over time.

- Real-Time Updates: Choose a tool that provides up-to-date information on your investments, including market prices and balances.

- Goal Setting: Look for features that allow you to define your financial goals, such as retirement planning or saving for a down payment.

- Customizable Reporting: Choose a tool that generates personalized reports based on your specific needs and preferences.

- Alerts and Notifications: Select a tool that provides alerts and notifications about key events, such as investment performance, account activity, or upcoming deadlines.

- Security and Privacy: Ensure the platform uses strong security measures to protect your financial data.

Tips for Choosing the Right Investment Tracking Tool

- Consider Your Needs and Experience: Determine your level of investment knowledge and the features you require.

- Look for User-Friendly Interface: Choose a tool that is easy to navigate and understand.

- Compare Features and Costs: Evaluate different options based on their features, pricing, and customer support.

- Read Reviews from Other Users: Get insights from other users about their experiences with different investment tracking tools.

- Try a Free Trial: Take advantage of free trial periods to test out the tool before committing.

Benefits of Using Investment Tracking Tools

- Gain a Comprehensive Understanding of Your Investments: Get a clear picture of your entire investment portfolio and track its performance.

- Monitor Performance and Identify Trends: Analyze historical data to identify patterns and trends in your investments.

- Make Data-Driven Decisions: Use data insights to make informed investment decisions and manage risk effectively.

- Stay Motivated and Achieve Financial Goals: Track your progress towards your financial goals and stay motivated to reach them.

Examples of Investment Tracking Tools

Personal Capital: A free portfolio tracker and financial planning tool that offers a comprehensive suite of features.

Mint: A free budgeting and investment tracking tool known for its user-friendly interface and mobile app.

Yodlee: A third-party financial data aggregation service that provides a consolidated view of your finances across multiple accounts.

Betterment: An automated investing platform that provides portfolio tracking and management services.

Wealthfront: A robo-advisor platform that offers automated investment strategies, portfolio tracking, and tax optimization.

Acorns: A micro-investing app that automatically rounds up purchases and invests the spare change in a diversified portfolio.

Beyond Investment Tracking: Portfolio Management

Investment tracking is an essential part of portfolio management, but it’s not the only element. Other key aspects include:

- Asset Allocation and Diversification: Determining the appropriate mix of asset classes in your portfolio to manage risk and maximize returns.

- Risk Tolerance Assessment: Evaluating your comfort level with investment risk to ensure your portfolio aligns with your risk appetite.

- Rebalancing Your Portfolio: Adjusting your asset allocation periodically to maintain your desired risk level and ensure your portfolio remains balanced.

- Understanding Investment Fees: Evaluating the fees associated with your investments and choosing options that offer reasonable costs.

Conclusion: Invest in Your Financial Future with Smart Tools

Investment tracking is a crucial part of managing your portfolio effectively. It allows you to monitor your investments, analyze performance, and make informed decisions to achieve your financial goals. Choose a tool that meets your needs, provides the features you require, and helps you stay informed. Embrace the benefits of technology to streamline your financial management and invest in your financial future.