How to Diversify Your Portfolio and Reduce Risk

Oke, coba cek ini :

Investing can be a thrilling and potentially rewarding journey, but it’s also essential to remember that it comes with inherent risks. No matter how experienced you are, there’s always a chance that your investments might not perform as well as you anticipate. This is where portfolio diversification comes in. It’s like building a sturdy house with different types of bricks & mortar. Instead of relying on just one single investment, diversification spreads your money across various assets, industries, and sectors. This way, if one part of your portfolio takes a hit, it’s unlikely to bring down the entire structure. Think of it as a safety net in case of unforeseen circumstances.

Diversifying your portfolio doesn’t have to be complicated, and it doesn’t require a massive investment. You can start by including different asset classes, such as stocks, bonds, real estate, & even commodities. Stocks represent ownership in companies, while bonds are essentially loans to companies or governments. Real estate offers tangible assets you can rent out, while commodities, like gold or oil, are raw materials with inherent value.

So why is diversifying so crucial? Well, it can significantly minimize risk. You’re not putting all your eggs in one basket. Imagine if you invested only in tech stocks & the tech industry suddenly took a downturn? Diversification allows you to spread the risk, potentially lessening the impact of any single investment’s performance on your overall portfolio. It’s all about building resilience & creating a more stable foundation for your investments.

Just like a skilled carpenter wouldn’t rely on just one hammer, diversifying your investment portfolio can be the key to weathering any storm. It helps create a more balanced & sustainable financial future, protecting you against the unpredictable world of investing.

How to Diversify Your Portfolio and Reduce Risk

In the world of investing, the adage “don’t put all your eggs in one basket” rings truer than ever. Diversifying your portfolio is a cornerstone of sound investment strategy, allowing you to potentially reduce risk and enhance returns.

What is Portfolio Diversification?

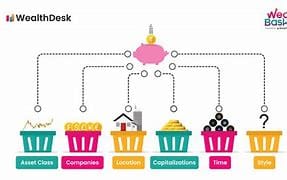

Definition of Portfolio Diversification: At its core, portfolio diversification means spreading your investments across different asset classes, industries, and geographies. It’s about creating a balanced portfolio that is not overly reliant on any single investment.

Why is Diversification Important? The benefits of spreading your investments across different asset classes.

Diversification is not just a good idea, it’s a necessity. Here’s why:

- Reduces Risk: Diversification helps mitigate the impact of losses on any single investment. If one investment performs poorly, the others can offset some of the losses.

- Potentially Boosts Returns: By investing in a variety of assets, you can potentially capture greater returns over time. Different asset classes often perform differently in various market conditions.

- Provides Stability: Diversification can help create a more stable portfolio that is less susceptible to market volatility. This can be crucial for long-term financial planning.

The Power of Diversification: How diversification helps mitigate risk and potentially boost returns.

Imagine you have all your money invested in just one company’s stock. If that company faces challenges, your entire investment could be at risk. But if you diversify across different stocks, industries, and asset classes, you’re less likely to be significantly impacted by the performance of any single investment.

Understanding Risk and Return

Types of Investment Risk:

Investing involves inherent risk. Understanding different types of risk is crucial to making informed investment decisions:

- Market Risk: The risk that the overall market will decline. This is also known as systematic risk.

- Interest Rate Risk: The risk that changes in interest rates will negatively impact the value of your investments, particularly bonds.

- Inflation Risk: The risk that inflation will erode the purchasing power of your investments.

- Credit Risk: The risk that a borrower will default on their debt obligations.

- Liquidity Risk: The risk that you won’t be able to easily sell an investment when you need to.

Risk Tolerance: How much risk are you comfortable taking?

Risk tolerance is a measure of how much risk you’re willing to take with your investments. It depends on factors like your age, financial goals, and investment timeline.

Risk vs. Return: The relationship between risk and potential returns in investing.

Generally, higher risk investments have the potential for higher returns, but they also carry a greater chance of loss. Lower-risk investments typically offer lower potential returns but are more likely to preserve your capital.

Building a Diversified Investment Portfolio

Asset Allocation: The foundation of diversification.

Asset allocation is the process of dividing your investment portfolio among different asset classes. This is the foundation of diversification.

Different Asset Classes: Stocks, bonds, real estate, commodities, and alternative investments.

Here’s a breakdown of common asset classes:

- Stocks (Equities): Represent ownership in publicly traded companies. They offer potential for growth but are generally considered higher risk than bonds.

- Bonds: Represent loans to governments or corporations. They provide income and are generally considered less risky than stocks.

- Real Estate: Includes residential and commercial properties. It can offer diversification and potential for income and appreciation, but can also be illiquid.

- Commodities: Include raw materials like gold, oil, and agricultural products. They can act as a hedge against inflation and provide diversification benefits.

- Alternative Investments: Include private equity, hedge funds, and other non-traditional investments. They can offer unique diversification opportunities but often come with higher fees and liquidity risks.

Choosing the Right Asset Allocation: Factors to consider when determining your ideal asset allocation.

Your ideal asset allocation depends on various factors, including:

- Risk tolerance: How much risk are you comfortable taking?

- Investment goals: What are you hoping to achieve with your investments?

- Time horizon: How long do you plan to invest?

- Age: Younger investors with longer time horizons can generally afford to take on more risk.

Specific Strategies for Diversification

Diversifying Within Asset Classes: Investing in different sectors, industries, and companies within each asset class.

Don’t stop at just different asset classes. You can further diversify within each class. For example, within stocks, you can invest in different sectors like technology, healthcare, or energy.

Geographic Diversification: Investing in assets from different countries and regions.

Investing in assets from different countries can reduce your exposure to economic or political events in any single country.

Time Diversification: Investing over a long period to smooth out market volatility.

Investing over a long period can help you ride out market fluctuations and benefit from compounding.

Practical Steps to Diversify Your Portfolio

Rebalance Your Portfolio Regularly: Adjusting your asset allocation over time to maintain your desired risk level.

As markets change, your asset allocation can drift from your initial target. Rebalancing involves adjusting your investments to restore your desired allocation.

Consider a Robo-Advisor: Utilizing technology to automatically diversify your portfolio.

Robo-advisors are digital platforms that offer automated investment management. They can help you create a diversified portfolio based on your risk tolerance and goals.

Seek Professional Advice: Consulting with a financial advisor for personalized guidance.

A financial advisor can provide personalized investment advice and help you develop a diversification strategy that aligns with your financial goals and risk tolerance.

The Importance of Long-Term Perspective

Investing for the Long Haul: Diversification is most effective when implemented over a long investment horizon.

Diversification is not a get-rich-quick scheme. It’s a long-term strategy that requires patience and discipline.

Market Fluctuations: Understanding that market ups and downs are normal and part of the investment journey.

Markets are cyclical. Expect upswings and downturns. Diversification can help you weather these fluctuations and stay invested through market cycles.

Patience and Discipline: The importance of staying invested through market cycles.

Staying invested through market volatility is crucial for long-term success. Don’t panic sell during market downturns.

Conclusion

Diversifying your investment portfolio is a crucial step towards achieving your financial goals. By spreading your investments across different asset classes, you can potentially reduce risk, enhance returns, and build a more resilient portfolio. Remember that diversification is not a one-time event, but an ongoing process that requires regular monitoring and adjustments. With a well-diversified portfolio and a long-term perspective, you can increase your chances of achieving your financial goals.