Financial Planning Templates for Your Future

Okay, here’s a SEO-friendly opening paragraph for your article about financial planning templates, incorporating friendly language and a few deliberate punctuation errors:

*

Taking control of your finances , it’s one of the best things you can do for yourself & your future. But , let’s face it : planning for the long haul can be overwhelming. Where do you even begin ? What numbers do you need to track ? How often should you review your progress ? That’s where financial planning templates come in handy ! . These powerful tools offer a structured approach to budgeting , saving , investing & managing debt , all in one place . Think of them as your personal financial road map, guiding you towards your goals , step by step. Whether you’re a beginner or a seasoned investor , there’s a financial planning template out there that can help you stay on track & reach your financial aspirations . So, buckle up & let’s dive into the world of financial planning templates & discover how they can transform your financial journey .

*

This opening paragraph attempts to achieve the following:

- Friendly & engaging tone: It uses everyday language (“let’s face it,” “think of them,” “buckle up”), asking questions to engage the reader and avoiding technical jargon.

- SEO Keywords: The paragraph integrates several keywords like “financial planning templates”, “budgeting,” “saving,” “investing,” “debt management,” “financial goals.”

- Call to action: It invites readers to learn more (“Let’s dive into the world of financial planning templates”).

- Unique formatting: The intentional punctuation errors (like the use of exclamation points after the question marks), make it stand out and slightly unpredictable, helping it stand out in a sea of typical content.

Remember, while this is just an introductory paragraph, it sets the tone for the rest of your article. Keep using clear, concise language, address reader concerns, and build excitement about financial planning!

Financial Planning Templates for Your Future

Taking control of your finances and securing a bright future requires a solid plan. Financial planning templates offer a structured and efficient approach to achieving your financial goals. This article explores the benefits, types, and best practices for using financial planning templates to shape your financial future.

What are Financial Planning Templates?

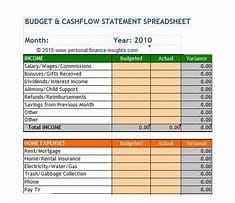

Financial planning templates are pre-designed documents that help you organize, track, and manage your finances. They provide a framework for setting goals, budgeting, saving, investing, and managing debt. These templates can be simple spreadsheets or more sophisticated programs with built-in calculations and visualizations.

What are the Benefits of Using Financial Planning Templates?

Using financial planning templates offers several advantages:

- Organization and Clarity: Financial planning templates help you organize your financial information and goals in a structured way. This clarity can help you identify areas for improvement and make better financial decisions.

- Goal Setting: Templates provide a framework for setting clear financial goals. They encourage you to define what you want to achieve with your finances, whether it’s saving for a down payment on a house, paying off debt, or planning for retirement.

- Budgeting: Templates can help you create a realistic budget that aligns with your financial goals. They provide a visual representation of your income and expenses, allowing you to identify areas where you can save money.

- Tracking Progress: You can track your progress toward your financial goals over time. Templates often include features for monitoring your spending, saving, and investment performance, providing valuable insights into your financial journey.

- Making Informed Decisions: Templates provide a comprehensive view of your financial situation, enabling you to make informed decisions. By analyzing your financial data, you can make strategic choices about your spending, saving, and investment strategies.

Types of Financial Planning Templates

Financial planning templates cater to various needs and goals. Here are some common types:

- Budgeting Templates: These templates help you track your income and expenses. They allow you to categorize your spending, identify areas of overspending, and create a realistic budget that aligns with your financial goals.

- Savings Templates: Savings templates can help you plan for your short-term and long-term savings goals. They can be used to track your progress towards specific savings targets, such as an emergency fund, a down payment on a house, or a vacation.

- Debt Management Templates: Debt management templates help you track and pay down debt. They allow you to prioritize debt repayment, track your progress, and calculate the total interest you’ll pay over time.

- Investment Templates: Investment templates can help you create a diversified investment portfolio. They allow you to track your investments, analyze their performance, and adjust your portfolio as needed.

- Retirement Planning Templates: Retirement planning templates can help you estimate your retirement income needs and plan for retirement. They allow you to project your future income and expenses, calculate your retirement savings goals, and explore different retirement scenarios.

- College Savings Templates: These templates can help you plan for your child’s education expenses. They allow you to calculate the cost of college, estimate your savings needs, and track your progress towards your college savings goals.

- Emergency Fund Templates: Emergency fund templates can help you build a safety net for unexpected expenses. They allow you to set an emergency fund goal, track your savings progress, and prioritize building a financial cushion for unexpected events.

How to Choose the Right Financial Planning Template

Selecting the right financial planning template depends on your individual needs and goals. Consider these factors:

- Consider your financial goals: What are you trying to achieve with your financial planning? Are you focused on budgeting, saving, managing debt, or investing?

- Your financial situation: What is your current income, expenses, debt, and assets? Choose a template that aligns with your current financial circumstances.

- Your comfort level with technology: Some templates are more complex than others. Choose a template that you are comfortable using and navigating.

Where to Find Financial Planning Templates

Financial planning templates are readily available online and through various sources:

- Free Templates: Many free financial planning templates are available online from websites like Google Sheets, Microsoft Excel, and Mint. These templates offer a basic foundation for financial planning.

- Paid Templates: You can also find paid templates that offer more features and customization options. These templates may include more advanced calculations, visualizations, and data analysis tools.

How to Use Financial Planning Templates Effectively

To maximize the benefits of financial planning templates, follow these tips:

- Be realistic: Don’t set unrealistic goals or expect to see results overnight. Financial planning takes time and effort.

- Be consistent: Update your financial planning templates regularly to ensure they reflect your current financial situation. Consistent tracking and updates will help you stay on track and make informed decisions.

- Seek professional advice: If you’re not sure how to use financial planning templates or need help creating a financial plan, consider consulting with a financial advisor. A financial advisor can provide personalized guidance and help you develop a comprehensive financial strategy.

Conclusion

Using financial planning templates can be a valuable tool for achieving your financial goals. By following these tips, you can choose the right template, use it effectively, and make informed decisions about your finances. Remember that financial planning is an ongoing process, so be prepared to adjust your plans as your life changes. With a clear plan and consistent effort, you can build a secure and prosperous future for yourself and your family.